Is Trump playing the YCC game, targeting Powell and tariffs?

·

Under Trump 2.0, USD slid ~11% in the first six

months, positive for export-heavy US MNCs, but US10Y bond yield remains around

4.3%

·

Despite Trump’s ongoing insult, Fed Chair Powell is

surprisingly cool; is there a tacit understanding?

·

US Treasury Secretary Bessent is now urging the Fed

to cut 50 bps in September (after the expected July hold)

US President Trump is now desperately

commenting against Fed Chair Powell almost every other day for not cutting

rates by at least 100 bps in H1CY25. Trump is now insulting Powell much more

than his 1st term in a deliberate pattern, talking about shadow Fed

Chair in a desperate attempt to keep US short-term (5Y/10Y) bond yields lower

as the US has to roll over almost $9T of treasury debt later this year

(H2CY25). This may be the main reason apart from a potential stagflation-like

scenario in the US late 2025 and 2026 because of Trump’s bellicose policies, from tariffs to immigration, which can affect both price stability and

employment.

Powell, on the other side, is maintaining that if

there were no big Trump tariff issues, the Fed would have started the rate-cutting

(normalization) process from Q1CY25 itself in an orderly manner. Powell and even most other FOMS policy makers

are stressing that the Fed has to raise rates to manage potentially high

Trumpflation, but the Fed will not raise rates as such tariff inflation may be

transitory. But at the same time, the Fed is not sure about the actual rate of

tariffs on the US merchandise imports (~3T/Year) and their effect on the

overall consumer spending and private capex. Thus Fed is now in wait &

watch mode; not in a position to cut or hike. Powell has made it clear that the

Fed works on the data outlook, not actual data.

Fed already frontloaded at least 50 bps of additional

rate cuts. Fed cuts 50 bps in September’24 quite unexpectedly, as by then the

probability of Trump 2.0 suddenly surged (after two ‘assassination’ attempts on

Trump during his election campaign). By October, it was almost clear that Trump

was coming back to the White House after a spirited debate performance against

Kamala Harris. Thus Fed has already cut at least 50 bps in advance,

anticipating Trump trade war 2.0. And all other major global banks also did the

same, led by the ECB.

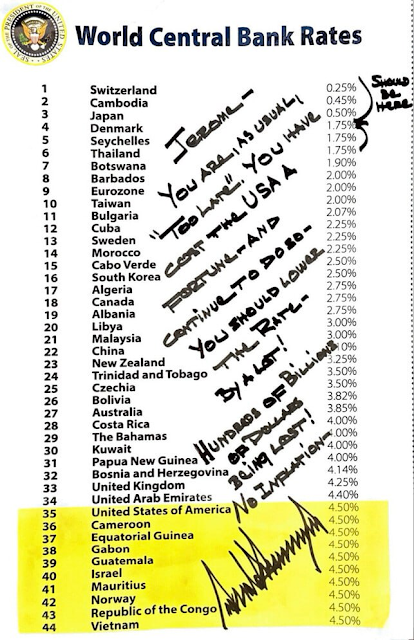

Trump’s comments

and rhetoric toward Powell

Trump has repeatedly criticized Powell for not

lowering interest rates enough, often arguing that high rates hurt economic

growth and increase borrowing costs for the government. In April 2025, Trump called Powell a “major

loser” and demanded immediate rate cuts, claiming there was “virtually no

inflation.” In May 2025, Trump met with Powell at the White House, reportedly

telling him it was a “mistake” not to lower rates. In June and July 2025, Trump

escalated his attacks, including a handwritten note accusing Powell of costing

the U.S. “a fortune” by keeping rates high and suggesting rates should be as

low as 1%.

In the Fox News *Sunday Morning Futures* interview

with his favorite TV anchor, Maria Bartiromo on June 29, 2025, President Trump

intensified his criticism of Federal Reserve (Fed) Chair Powell, focusing on

Powell’s refusal to lower interest rates. Trump called Powell a “bad person”

and signaled his intent to replace him with someone more aligned with the White

House’s push for lower rates, stating, “We’re going to get somebody into the

Fed who’s going to be able to lower [interest rates].” He discussed the

challenge of refinancing $9 trillion in U.S. debt, arguing that high interest

rates under Powell’s leadership were costing taxpayers “hundreds of billions of

dollars.” Trump’s remarks were part of a broader pressure campaign, as he

reiterated his frustration with Powell’s monetary policy, which he claimed was

stifling economic growth.

Highlights

of Trump’s anti-Fed/Powell comments in his Fox interview: June 29

·

We have a stupid

individual at the Federal Reserve

·

Don't want to

pay for a 10-year debt at a higher rate

·

We should be at a

1% or 2% interest rate

On July 1,

2025, Trump posted on his Truth:

·

Jerome “Too Late” Powell and his entire Board

should be ashamed of themselves for allowing this to happen to the United

States. They have one of the easiest, yet most prestigious, jobs in America,

and they have FAILED — And continue to do so. If they were doing their job

properly, our Country would be saving Trillions of Dollars in Interest costs.

The Board just sits there and watches, so they are equally to blame. We should

be paying 1% Interest, or better!

Trump also

targeted Powell for reckless spending of Federal funds

In his recent Congressional Testimony, Powell was

grilled by some Republicans about alleged ‘lavish’ Fed office decoration

(renovation), wasting taxpayers’ money, especially at a time when the Fed is

running at a big notional loss (MTM). A

Bloomberg article on July 2, 2025, reports that Federal Housing Finance Agency

(FHFA) Director Bill Pulte called for a congressional investigation into

Federal Reserve Chair Jerome Powell, accusing him of political bias and

deceptive testimony during a Senate Banking Committee hearing.

Pulte’s statement, posted on X, claimed Powell’s

remarks about a $2.5 billion renovation of the Fed’s Washington, D.C.,

headquarters were misleading, citing Senator Cynthia Lummis’s critique of

Powell’s denial of lavish upgrades like a private dining room, special

elevators, and water features. Pulte argued these inaccuracies, combined with

alleged bias in maintaining high interest rates (4.25–4.5%), warranted Powell’s

removal “for cause.” President Trump amplified this on Truth Social, calling

Powell “Too Late” and demanding his immediate resignation, echoing his June 29,

2025, Fox News comments criticizing Powell’s rate policy.

On July 3,

Trump echoed Pulte about Powell, sharing the link to the BBG article:

·

“Too Late”

should resign immediately!!!

·

“Fed Chair

Should Be Investigated by Congress, FHFA Head Says”

Pulte’s call focuses on Powell’s June 24–25, 2025,

Senate testimony, where he dismissed reports of extravagant Fed renovations as

“misleading.” Pulte, citing Lummis, claims Powell lied, pointing to 2021 Fed

planning documents that allegedly contradict his statements.

Political

Pressure: This aligns with Trump’s

ongoing feud with Powell, whom he appointed in 2017 after a long interview

drama involving several potential candidates, including even Yellen. Now, Trump

is expressing his ‘mistake’ for his decision to appoint Powell, followed by his

reappointment by Biden. Pulte, a Trump ally, has been vocal on X, accusing

Powell of harming the housing market by keeping rates high amid tariff-driven

inflation concerns. House Judiciary Committee Chair Jim Jordan indicated

lawmakers would “look at” the issue but hadn’t discussed a specific

investigation. A recent Supreme Court ruling shields the Fed from direct

presidential ousting, limiting Trump’s ability to fire Powell before his term

ends in May 2026.

Treasury

Secretary Scott Bessent

On July 3, 2025, during an interview on Fox

Business’s *Mornings with Maria*, Bessent addressed speculation about Powell’s

future, avoiding direct calls for resignation but implying Powell’s spending

oversight at the Fed was inadequate. He stated that the administration was

focused on eliminating “waste, fraud, and abuse” and suggested it was “healthy”

for the Fed to control spending, aligning with Trump’s broader fiscal

tightening agenda. Bessent also sidestepped questions about his interest in

replacing Powell, saying he would go “where the president thinks I am best

suited” but emphasizing that the administration had “a lot of great candidates”

for the Fed chair role.

Bessent suggested Powell’s oversight of spending at

the Fed (e.g., the $2.5 billion Fed headquarters renovation) was inadequate. Bessent

had previously floated the idea of appointing Powell’s successor to a Federal

Reserve Board vacancy in January 2026, potentially elevating them to chair when

Powell’s term ends in May 2026. He told Bloomberg TV that the administration

was already considering candidates, signaling a proactive push to replace

Powell (Shadow Fed Chair).

In a Bloomberg TV interview on June 30, Bessent

discussed Fed policy and the process of replacing Powell, whose term as Fed

Chair ends in May 2026. He criticized the Fed’s hesitancy on interest rate

cuts, stating, “They seem a little frozen at the wheel here,” referencing their

slow response to inflation in 2022 and suggesting a similar caution in 2025

despite market signals for rate cuts. He argued that inflation from Trump’s

tariffs would be transitory, countering Powell’s concerns about tariff-driven

price increases. Bessent also outlined plans to work on Powell’s successor in

the coming weeks and months, mentioning potential candidates already at the

Fed, such as Governors Christopher Waller and Michelle Bowman.

Highlights

of comments by US Treasury Secretary Bessent: July 3

·

Bessent was

asked if he agrees with Trump's call for 3%-pt Fed cuts. Declines a specific

answer

·

The market is signaling

Fed rate cuts.

·

As per Fed’s

model, Fed should have cut rate multiple times by now; failure to do so may

result in a drastic one-time rate cut in September’25

·

If the Fed

doesn't cut here, maybe the September cut will be bigger

·

We are at very

high real interest rates here

·

We're going to

see things take off by Labor Day in September

·

Bessent signals that

Trump-appointed Fed members have a different take

·

There are lots

of good candidates for Fed chair. We will start working on that in the Fall

·

We expect to see

about 100 nations get a minimum 10% reciprocal tariff

·

We're going to

be announcing several trade deals

·

I expect a

flurry of trade deals before July 9th

·

China's currency

is non-convertible and thus not comparable to USD for a potential replacement

of USD AS global reserve currency

·

If the euro hits

$1.20, Europeans will be squawking as an export-heavy economy

·

The demise of

the dollar was predicted many times in the past

·

It's very

difficult to predict debt 10 years out

·

I'm confident

going in the right direction on debt post-tax

·

The dollar's

price has nothing to do with strong-dollar policy; the USD price is subject to

market volatility

·

I expect

stablecoin legislation will increase demand for US Treasuries

·

$2 trillion in

possible stablecoin US Treasuries demand

·

Debt-to-GDP is

expected to be well into the 90% range by the end of Trump's term

·

We will use

T-bills to refill the Treasury cash account

·

We will see US

banks take up more of the debt issuance

·

There could be

an increase in US financing needs based on yields

·

I do expect to

accomplish the 3-3-3 plan by the end of Trump's term (3% real GDP growth, 3%

fiscal deficit, and an increase of US oil production by 3 mbpd)

·

Markets signal

the tax bill is fiscally prudent and pro-growth

·

The markets are

telling us they like the tax bill

·

There are lots

of good candidates for the Fed chair. We will start working on that in the Fall.

·

China is

shortening rare earth export approvals for European companies

·

Trump will

determine if nations are talking in good faith.

·

Bessent on Jobs data:

Any one month can be noisy. Overall trend is good

·

Overall, the

jobs report was a good number

·

Looming election

in Japan may be constraining talks

·

Japan is in a tough

spot now, with the upper House election

·

US Trade

Representative Greer will be working over the weekend with the EU

·

We'll see what

we can do with the EU

·

I met with my EU

trade counterpart this morning

·

Nations should

be careful. Their rate could boomerang back to the April 2nd rate.

·

Retail margins

rose in COVID. There may be some normalization

·

We are going to

see more trade deals

·

Tariffs could

lead to a one-time price bump

·

There is a

significant risk that upward pressure on prices will be around for some time

·

20% is the

reciprocal rate for Vietnam

·

Vietnam's 20%

tariff doesn't stack on top of 10%

·

I understand the

Vietnam trade deal has been finalized in principle

·

What we've seen

so far is that tariffs haven't hurt

·

I'm going to

stick with the market's take, not economists

·

Trump is the

best President in the US so far in terms of economic knowledge

Trump’s

Politicization of the Fed is undermining the credibility of USD/UST

Bessent is accusing Powell and the Fed of “tariff

derangement syndrome,” claiming their refusal to cut rates was overly

influenced by fears of tariff-driven inflation. He noted that the Fed cut rates

by 50 basis points in September 2024 when inflation was higher, suggesting

inconsistency in Powell’s current stance and trying to help Democrats. Bessent’s

comments reflect a strategic push to prepare for Powell’s exit, with discussions

about appointing a “shadow chair” as early as January 2026 for a 14-year Fed

Board seat, potentially transitioning to Chair in May 2026. This suggests an

attempt to pressure Powell indirectly rather than an outright demand for

resignation, though it aligns with Trump’s aggressive rhetoric.

Bessent’s critique of Powell’s “frozen” policy

reflects frustration with the Fed’s data-driven approach, which prioritizes

inflation control amid tariff uncertainties. Powell’s caution stems from the

2021–2022 inflation surge, making the Fed wary of easing under political

pressure, which could undermine its credibility. Bessent’s comments, alongside those from other Trump admin officials

like Karoline Leavitt and FHFA Director Bill Pulte, suggest a coordinated effort

to scapegoat Powell for economic challenges, such as high borrowing costs or

tariff-related market and economic volatility. However, Bessent’s earlier

warnings (April 2025) about the risks of firing Powell—market instability and

higher yields—indicate he’s balancing Trump’s aggression with a more measured

approach to avoid financial disruption.

Conclusions

Overall, Trump may be trying to keep the USS and US

bond yields lower by intentionally attacking Fed Chair Powell, coupled with his

bellicose tariff and economic policies (Big & Beautiful Bill-Budget plan).

Trump needs lower borrowing costs to fund his deficit spending and also lower

USD to make US exports competitive. The US dollar index slid almost 11% in

H1CY25 under Trump 2.0, unprecedented in recent times. A lower USD is positive

for export-heavy US MNCs.

But the US10Y bond yield is hovering around 4.30% on

average as it’s related to US average core/PCE inflation, inflation

expectations, Fed stance (monetary policy), and also fiscal policy. Prices of

bonds in the secondary market depend on supply and demand; as the market is

aware of a potentially higher supply of US bonds in the coming months to

refinance existing $9T public debt, the price of 10Y UST may not fall drastically

even if the market is now discounting Fed rate cuts from September’25. Overall,

USD is now near the technical demand zone (positional support), while 19Y UST

is around the supply (positional resistance) zone.

Similarly, USDJPY and USDCAD are now near the short-term

support (demand) zone, while GBPUSD and EURUSD are near the resistance (supply)

zone. Looking ahead, USD, US bond yield may surge, while equities, and USTs, may

slump after Trump signs BBB and higher reciprocal tariff letters to at least

10-15 major trading partners (out of 18), including China. Trump may extend his

tariff pause till at least December’25 to save the US economy from uncertainty, a potential supply shock, and stagflation. But in that scenario, overall

uncertainty remains.

Technical

outlook: DJ-30, NQ-100, SPX-500 and Gold

Looking

ahead, whatever may be the narrative, technically Dow Future (CMP: 44800) now has to sustain over 45000 for a

further rally towards 45300/45800* and only sustaining above 45800, may further

rally to 46100/46500-47100/47200 in the coming days; otherwise sustaining below

44950, DJ-30 may again fall to 44200/43900-43400/42400 and

41700/41200-40700/39900 in the coming days.

Similarly,

NQ-100 Future (23000) now has

to sustain over 23100 for a further rally to 23200/23600-23800/24000 and

24100/24450-24700/25000 in the coming days; otherwise, sustaining below 22900,

NQ-100 may again fall to 2400/22200-21900/20900-20700/20200 and

19890/18300-17400/16400in the coming days.

Looking

ahead, whatever may be the fundamental narrative, technically SPX-500 (CMP: 6275) now has to sustain over 6400-6450 for

a further rally to 6525/7000-7500/8300 in the coming days; otherwise,

sustaining below 6350/6300-6250/6200, SPX-500may again fall to 6000/5800-5600/5300

in the coming days.

Technically Gold (CMP: 3350) has to sustain over 3375-3395 for a further rally to 3405/3425*-3450/3505*, and even 3525/3555 in the coming days; otherwise sustaining below 3365-3360, Gold may again fall to 3340/3320-3300*/3280 and 3255/3225-3200/3165* and further to 3130/3115*-3075/3015-2990/2975-2960*/2900* and 2800/2750 in the coming days.